Chapters

Shippers find themselves at a crossroads when it comes to moving their freight as quickly and efficiently as possible, while still minimizing costs. One method to achieve these goals is to utilize a third-party logistics service provider (LSP).

An LSP is a company who is a liaison between shippers and asset carriers. Essentially, an LSP acts as a middleman to connect shippers with carriers in the LSP’s network that best match the needs of a certain shipment. Beyond ensuring shippers have the carrier with the best service and value to their needs, there are several other advantages to utilizing a logistics service provider..jpg?width=400&name=business-man-gd4a662905_1920%20(1).jpg)

While an LSP’s definition closely matches a freight broker and they operate under the same FMCSA operating authority, the 3PL logistics service provider offers far more capabilities to the shipper community.

Over the years, freight brokers have taken a backseat in the logistics market, as shippers have capitalized on the strengths logistics service providers have over freight brokers.

The transformation from a freight broker to a logistics service provider has occurred as a result of transparency, technology, market forces, sophistication and knowledge brought in by a new generation, capital and big data platforms.

As a result, the logistics service providers of today are key value-add organizations that help shippers elevate their ability to drive a competitive advantage through their expertise, industry knowledge, technology and high level market analytics.

Before jumping into the details of the reasons and benefits shippers engage a 3PL, let’s take a broad stroke view of the basics of why the 3PL logistics service model is accelerating in taking market share.

Flexibility

Companies have flexibility and options in finding their freight capacity requirements through an LSP because of the thousands of carriers they have active, approved and tied in with their transportation management software platform (TMS).

The reason and importance of having access to thousands of motor carriers is because of the fragmentation of the market. According to the US Department of Transportation, there are over 700,000 registered motor carriers, with 91% operating six or fewer trucks and 97.3% operating fewer than 20 trucks. These 700,000 motor carriers make up the $700 billion in total market share.

The logistics service provider is not tied to any one carrier or have fixed assets they have to be full of freight to keep the business solvent, which allows them to mold their shippers’ capacity requirements to the carriers when shifts are required to obtain the best service and rates.

Saves Time and Resources

Companies inherently have limited time and resources devoted to the shipment process.

By handing off the freight to an LSP, shippers can maximize efficiency internally because companies can forego investing in additional assets ranging from office space, people, equipment and software.

LSPs take the resource requirement off their shoulders because shippers do not have to be concerned with managing the daily book of shipments from origin to destination, thus giving them time to address other issues in their day.

Knowledge and Expertise

Third party logistics service providers have an intimate knowledge of the industry that is both broad and deep on a variety of logistics and supply chain topics.

This knowledge helps drive a better service and economics for the shipper because LSPs move their daily freight capacity requirements for the most reputable, reliable and cost effective carriers to benefits the shippers’ bottom line.

The LSP also has the technology to optimize the method by which a shipment moves at the least cost freight mode that meets the required delivery date.

Technology

LSPs operate the best Transportation Management Systems (TMS) technology in the business.

The reason for LSPs operating the best technology is:

- Business supports the cost investment

- Market requires to offer top tier services

- Provides operational efficiencies to keep costs down

- Gives the ability to easily integrate with customers and market platforms

- Rating and route optimization

- Reporting and analysis to improve its business and that of its customers

Ebook: Comprehensive Guide on Managed Transportation

Download A Free Copy of Our eBook "Comprehensive Guide on Managed Transportation" to discover managed TMS will add capacity, reduce costs and improve logistics performance.

A study put out by the Aberdeen Group found 83% of companies interviewed have become aware of the cost and service impact transportation has on the overall supply chain performance of their company and see transportation as more than just an isolated budget line item to be monitored. The strategy many shippers have taken to change results for the better is bring a managed transportation service strategy through a well-respected logistics service provider.

Functions of a Logistics Service Provider

With the basics behind us, let’s outline the functions of an LSP and their execution model.

First the shipper calls or sends the freight loads information to their 3PL with the following details:

- Ready Time

- Required Delivery Date

- Origin

- Destination

- Pieces

- Weight

- Dimensions

These details are important in determining what carrier will bring the best service and value to the shipper, as the LSP runs the requirement through its freight optimization engine within the TMS. In this process, the software runs through 1,000s of scenarios to choose the best mode and looks for freight consolidation opportunities.

The 3PL will tender the freight to the motor carriers and manage the shipments all the way through to delivery. It will then wait for the invoice, proof of delivery (POD) and other related documents, and then audit and invoice the shipper.

When to Use a Logistics Service Provider

As previously mentioned, there are many reasons to utilize LSPs that drive their value and become the foundation of many shippers’ tactical logistics strategy. In the next section we will address how 3PL logistics service providers have moved into the strategic position, thus surpassing the freight broker’s service offering..jpg?width=500&name=transport-gf0fe91969_1920%20(1).jpg)

Accessing Freight Capacity Quickly

LSPs have technology on hand that quickly rate and route optimizes across its motor carrier agreements, and tenders the freight out on a waterfall basis. This process happens within minutes.

For the situations where the contracted carriers do not have the capacity in a given area to meet the freight requirements, the TMS taps into multiple truckload load boards to find the capacity at the price needed. Motor carriers respond within minutes with pricing and their MC number, which then validates they are operating legally and are under contract.

If the carrier is under contract, then the shipment is booked within minutes.

Carrier Pool Size

The strongest 3PLs have an expansive carrier network that is both deep and wide.

Keep in mind here that the size of a 3PL does not necessarily indicate the number of carriers they have under contract. The reason for this is technology is also taking over this part of the freight brokerage industry within minutes 3PLs can have access to over 100,000 motor carriers from a group that strictly focuses on setting up and monitoring motor carrier authority, safety and their insurance.

Cost Saving

LSPs have the ability to help shippers save money, as we already discussed, and going along with their “strength in numbers,” logistics service providers will know the strengths and weaknesses of most the motor carriers they are contracted with. The LSP and carriers are in constant contact sharing where they need freight to balance their networks.

Third party LSPs are always on a mission to find a better mouse-trap for their freight, their customers’ and through special consulting optimization projects they are assigned to perform for shippers.

Additionally, to best optimize, technology is the primary investment. LSP’s can easily access pooling and modal conversion and freight consolidation opportunities to provide lower cost for shippers.

Scalable Capacity on Variable Cost Basis

A 3PL allows shippers of all sizes bring in talent, technology and knowledge very quickly and in a way that scales a company’s logistics and supply chain requirements on a variable cost basis versus stair steps, where cost, value and need do not intersect.

.jpg?width=400&name=inspection-g0b3e5260b_1920%20(1).jpg)

Carriers are Vetted

Logistics service providers excel at vetting each carrier they decide to put into their logistics service network.

This vetting process consists of ensuring each carrier is running with a valid operating authority, insurance and has a good safety rating that allows them to run over-the-road (OTR).

Shippers can find themselves with legal trouble when the carriers they use to move their freight do not check all the boxes making LSP’s invaluable because of the thoroughness in their motor freight carrier validation process.

To Improve Their Supply Chain and Bottom Line

Whether operationally more efficient or more cost effective in carrier routing, logistics service providers efficiency will move more for less, which ultimately affects the bottom line.

In summary, LSPs allow companies to stick to fulfilling their value proposition, while letting the 3PL do what they are best at in their field of expertise. The combination of both will give the shipper a competitive advantage others will find it difficult to overcome.

How to Select the Best LSP for Your Company

The decision has been made that your company wants to outsource a piece or all of your logistics work to a third party LSP’s. What’s next?

In the 3PL market, like every other industry, there are choices and each has their own strengths and weakness.

Below is a list of all the aspects you will want to consider when narrowing down your choices in the search for a broker.

Properly Licensed

First and foremost it is important to make sure the logistics service provider is properly licensed by the Federal Motor Carrier Safety Administration (FMSCA), which is a quick look-up in their database.

The database holds information on the status of the broker (active or inactive), their insurance, surety bond and history changes.

This information is crucial in ensuring the brokerage has a good operating “track record” and is doing all of the things required.

Financial Stability

Logistics service providers can sometimes be out of the market faster than they come in it, so it is important to learn about the company’s history and financial strengths. Smaller firms are quicker to go under than larger firms, but larger firms are still not immune to bankruptcy.

Financial stability is important to review because if a freight brokerage closes its doors, any and all motor freight carriers that were not paid by the 3PL logistics service provider can and will go after the shipper for payment, even if the shipper already paid the broker for the freight, which results in frustration because the shipper will end up paying for those loads twice.

The 3PL LSP is required by law to hold a $75,000 surety bond to help cover situations like the above, but the bond will cover very little because bankrupt freight brokers are in much deeper debt.

Insurance

Often times shippers are thrilled with the rate an LSP is providing that they forget to ask about their insurance. While 99.9% of the times there will not be an issue, the time to figure out the cargo coverage is not when there is a claim..jpg?width=500&name=business-g4543f79e2_1920%20(1).jpg)

With that in mind, there are a few points of emphasis to observe with the insurance of LSPs.

The first point is to understand whether the LSP has a contingent cargo or shipper’s interest policy. Since LSPs hold a freight broker operating authority, the motor carrier they utilize on a shippers freight is the first line of cargo coverage. In the event the motor carrier coverage fails, the contingent cargo insurance will come into the equation and cover damages.

Superior to contingent cargo insurance is shipper’s interest insurance, which is primary coverage that is of equal value to the motor carrier.

Validity of insurance should be checked via the FMCSA database mentioned previously.

Last, but not least is to check the deductibles the LSP has with its motor carriers. Many are surprised to find out there is a $25,000 deductible, which would cause trouble when working with a smaller broker trying to cover the difference.

Carrier Compliance

The motor carrier network is expansive for logistics service providers, so it is important information to know how the LSP select and monitor their carrier base. It is important to ask questions on how the carriers are approved, what is the policy for delisting carriers, what is the daily review process to ensure the motor carriers used are legal, how many freight carriers are active and under contract, etc.

All points are important to ensure the freight a shipper gives to an LSP is legal and there are plenty of carriers the LSP has active and approved or the service will suffer as they will likely be posting the freight on load boards more often than not.

Years in Service

The bottom line is the more years in service, the more reliable the 3PL.

Shippers want seasoned professionals that not only know how to manage their freight, but also their own business. Longevity speaks to both points.

Multiple Modes & Services Offered

LSPs providing multiple modes of freight give shippers more options at the best price from a single source. When LSPs are well versed in several areas of expertise, they bring more to the table to help shippers grow their business and reduce costs.

Operational Model

There are two thoughts on operations within the 3PL market.

Some distribute the work by task and shift across their entire line of business, while others believe in customer managers that only focus on a small subset of customers and then do all the work for them.

There are pluses and minuses to both, so when shippers select their LSPs they need to feel comfortable with how their business is handled in the good, bad and after hour times.

Operating System

System capabilities are everything in optimization, communication, access to capacity, industry data and efficiency.

To this day we still see shippers using Access and Excel to manage their logistics and supply chains.

New and updated technology is necessary for a successful 3PL and shipper relationship to flourish making it critical for the shipper to know and understand the transportation management system (TMS) their logistics provider operates.

Basic Business Footprint

It is important to look at the business from top to bottom when searching for a 3PL logistics service provider.

It is in the shippers best interest to know who is working for them and how they represent themselves in all aspects - online, in-person, reputation with other shippers, etc.

If the shipper does not find an online presence, then the shipper should acknowledge the red flags overall and their legitimacy should be questioned.

All-in, 3PL logistics service providers are a valuable asset for a company, but due diligence must be practiced to ensure there is a mutually beneficial fit on services and culture.

Outsourcing Advantages

As was mentioned earlier, there is a difference between a freight broker a 3PL logistics service provider.

An LSP outshines a freight broker with its ability to offer shippers a managed TMS service solution where shippers outsource all their logistics functions, which are outlined below.

The reasons and importance of why shippers choose the outsourced model are numerous, so let’s take a look at the core values and then jump into comparing some of the leading 3PL logistics service providers.

Focus on Core Business

As we have previously discussed, shippers can stay focused on finding ways to put their company on the road to success. Without having to devote time managing the shipping department, businesses can focus on their market value proposition to excel their business forward.

Logistics is Complex

Logistics stretches beyond a truck and freight. There are several aspects to the industry requiring extensive education and study. Companies often do not have the resources to push the envelope and bring in the talent and technology to optimize their logistics team for cost and service performance.

Access to Top Technology Solutions

Third party LSPs are equipped with technology that can take logistics cost saving solutions to the next level with their advanced rate and route optimization software, along with leveraging their carrier base for their shippers.

LSPs invest in the highest capable transportation management systems (TMS) to ensure the most efficient and effective solutions can be marketed and executed to advance the shipping community. The investment in the technology never ends or the company will perish, as other 3PLs continue to push their capabilities and collaborative platform even further with their business intelligence (BI) software capabilities and artificial intelligence to optimize supply chain networks.

Individual companies often cannot do this on their own, while a 3PL has many shippers it has within its four walls to amortize the cost across for the benefit of all.

Reduce Back Office Work

When it comes to the invoicing process, putting it in the hands of many employees can be time consuming and susceptible to more mistakes.

3PLs have the technology and process to run circles around an individual company. By giving the back office functions to the experts, a company can use those resources for other value-add activities within its supply chain associated with its vendors and customers.

In addition to processing invoices and paperwork associated with all shipments, the 3PL can leverage its technology to analyze the data to find a better mouse traps for its customer base. The 3PL will also be able to benchmark the logistics costs against the market via the collaborative databases the logistics experts have developed.

Driving Cost Savings & Efficiencies

Listed below are the various areas a 3PL logistics service provider drives freight and operational cost savings for shippers:

- Operation Efficiency

- People Costs

- Training Costs

- Cost of Technology

- Implementation Costs & Continual

- Technology Investment

- Leveraging the Buy of Motor Freight Carriers

Increase Customer Satisfaction.jpg?width=400&name=job-interview-g9b645c1be_1920%20(1).jpg)

LSPs leverage technology, people and process to address problems and provide solutions on an hourly basis for a shipper’s customer base, while also being very transparent in the activities as it reports out and allows full access into the TMS and other systems.

Improve Risk Management

Many aspects of a logistics and supply chain can fly under a company’s radar because their core competencies often don’t give them the time to learn what they do not know in logistics.

Third party LSPs live in logistics everyday. It is there business to know the rules, regulations and potential pitfalls that protect companies from making errors that put them in the line of liabilities that come with freight and logistics.

Leverage Freight Carrier Network

By outsourcing, companies can expand their freight capacity network immediately. LSPs have the expertise and technology to tap into ten’s of thousands of motor carriers within seconds.

In addition to finding the carriers that can cover a shippers lane, they also have the buying power leverage to get the best price for the freight service required.

All of these factors help give shippers scale and flexibility to ramp up or down within its regular and seasonal capacity needs.

Expertise Leads to Innovation

If a shipper has never engaged with a 3PL they will quickly realize that their expertise can lead the way to advancement in the tactical and strategic way that were otherwise not in the realm of thinking until the LPS was brought into the equation.

Improved Supply Chain KPIs

Talent, technology and repeatable processes lead to increased visibility, reporting and analytics to improve and optimize a shipper’s ability to service its freight lanes in the most efficient method possible.

Consequently, cost reduction, on-time percentages and ability to measure improvements will follow quickly.

Better Resource Management

Transparency and visibility brought to the supply chain equation will translate to time for adjusting and allocating resources necessary to carry out the product order cycle through to final delivery for customers.

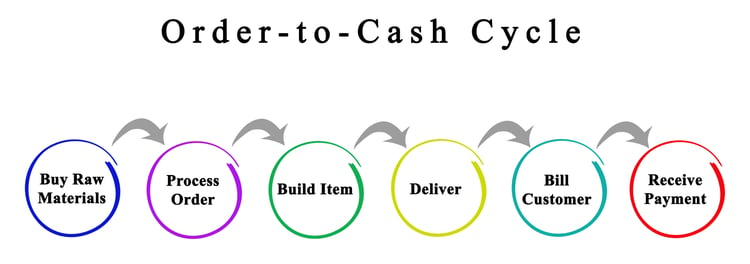

Shorten the Order-to-Cash Cycle

As illustrated above, six steps comprise the order-to-cash cycle, which is really the complete supply chain management cycle, once the customer experience is added.

So, while there are multitudes of content on logistics and supply chain, the above is the essence of why having a strong supply chain is so important to companies. The companies that can turn a cash drain into a cash surplus will be the companies that can invest quicker in the next idea its customer base will be wanting.

Capital Preservation

Capital preservation comes in several forms when a 3PL is employed.

As previously mentioned, a well tuned order-to-cash cycle will turn raw materials and finished products into cash quicker. This will lead to lower inventory levels and safety stock requirements.

Capital preservation will also come through leveraging the technology a 3PL brings into its outsourced managed TMS service solution because it will be able to bring the technology in on a variable cost basis, with no upfront cost to ownership.

The outsourced logistics model will also save cash from freight savings and requiring additional people to manage the process internally.

Vendor Relationship & Management

There is always one person in the company that will be apprehensive of outsourcing..jpg?width=400&name=secretary-g6ec508c2a_1920%20(1).jpg) The feeling of apprehension comes from the thought that their company would be handing over 100% of the control of a portion of their business to an outsourced group that is outside of its four walls, which can be a scary thought.

The feeling of apprehension comes from the thought that their company would be handing over 100% of the control of a portion of their business to an outsourced group that is outside of its four walls, which can be a scary thought.

From the outside looking in it may appear that way, but the reality is, by aligning with a 3PL that is a good cultural and capabilities fit, the process can only be enhanced. The transparency, data, information management, reporting and analysis provided, give shippers the tools and dashboard to enhance their relationships with their vendors and customers.

Lastly, the overall atmosphere of putting the logistics functions into the hands of a third party logistics company opens up an atmosphere of positive and proactive communication for all supply chain stakeholders. Typically when there is an acceptance of a new process and procedures, and people move past the “this is not how it used to be done” mentality, management begins to see the improvements it has a fly-wheel effect with each step making the process moving the flywheel even faster toward the ultimate goal of building a sustainable logistics and supply competitive advantage.

It is also vital that the company have a point person or liaison team managing the 3PL to ensure they connect them with the correct stakeholder throughout the process.

Outsourcing Disadvantages or Concerns

It would be false to say there are not any disadvantages in outsourcing. With that in mind, let’s take a quick walk through them, but before doing that there needs to be some context on the disadvantages.

Quite often disadvantage come from a lack of due diligence applied during the selection process. While the third party is often the one that is blamed, it is more often appropriate for parties to accept blame.

Sometimes the company that is looking to outsource does not know what they don’t know, meaning they made claims on what would be required to handle their business being one thing, when in reality turns out to be something completely different. The more experienced 3PL will often find where there may be misalignment on the horizon, but this may not always be the case. Sometimes this is because of other priorities, but more often than not, this occurs when a less experienced sales and operations person is put as the lead.

Either way, blame can be put at the feet of both the company and third party.

For this reason, a few of the questions that should be asked of the 3PL are:

- How does the LSP select their clients?

- Explain both the best implementations and the worst

- Share situations where the company has walked away from an opportunity

The two other situations that can occur that can cause disadvantages are 1) the lack of alignment on the internal goals or 2) a single focus of the steering committee. Either of these areas breaking down in the implementation and “go-live” phase can drive outsourcing disadvantages and often lead to failure.

Now that we have covered the basics, let’s look at some of the disadvantages of outsourcing logistics and supply chain functions to a 3PL:

Cultural or Strategic Misalignment

This is the number one disadvantage of outsourcing. Not having cultural or strategic alignment makes for a very difficult relationship and sub-optimizes the entire outcome and wipes out most if not all advantages because both the company and 3PL are going in different directions.

Integrating Information Technology

One of the most powerful aspects of an outsourced relationship is being able to tie in a company’s internal systems with the powerful technology of the LSP.

If not done correctly, this can be a disaster and will not allow the functionality to be obtained to optimize the solution and drive the results outlined in the decision process.

Typically the reason for a poor integration is not everyone is part of the process of deciding what information was required by all the stakeholders, both internal and external.

The key is to map everything out on the front end and get sign-off across the entire organization before allowing any IT programmer to put their fingers on the keyboard because once the process begins any changes will cause delays and increase costs.

Possibly Unforeseen Costs

An outsourced solution decision is often made on the financials, although the end results are often hard to quantify what a top tier logistics and supply chain program will mean for a company.

So, with the outsourced decision being financially focused any unforeseen cost drops the ROI of the decision. With that in mind, it is key to understand all the costs, as well as what would change the ability to keep the implementation on schedule.

The implementation is often an overrun because the company does not typically align enough resources or does not have the focus to keep on task. No blame here. They don’t implement a fully outsourced logistics solution every day or even every year, so the number of resources required will often be under planned.

Expertise Is Outside vs Internal

When handing the reins to a 3PL a company make sure not to pass on the idea of building an internal team of experts with all the knowledge.

A well-aligned 3PL and company relationship will allow knowledge and expertise to be passed to an organization, but it will not be wide and deep based like it would be if the work were done internally.

Even with the previous being said, there is a cost of insourcing talent. The cost is driven because of the time it will take to develop the skill set and, the pay structure required for the skills and knowledge.

Feeling of Not Having Control… or Wanting More Control

While all the above are disadvantages or concerns with outsourcing, the feeling of lacking control or wanting more control often drives a wedge or causes performance issues that quite often cannot be overcome and produce disastrous results.

With that said, the company needs to look itself in the mirror and make sure outsourcing is what they truly want to do before jumping in with both feet. The reasons are evident and the relationship is like a marriage and both can be painful if there is not a good give-and-take throughout the time together.

Logistics management’s goal of moving product in the most efficient and secure manner from point A to point B at the least cost and best service is what originally drove the importance of having a strong logistics strategy that could be executed flawlessly for its customers. Under this thought process, companies looked at logistics as an outbound cost center to fulfill customer orders.

Over the past decade, the view on logistics has changed from the cost center mentality to a key strategic component that can drive a competitive advantage in its industry.

With the change in how logistics is viewed, companies often confused the terms supply chain and logistics. Logistics is a subset of process that fall under supply chain management that include planning, executing, communicating and coordinating the movement of goods within an organization’s network of stakeholders. This network includes:

- Suppliers

- Production & Manufacturing

- Packaging

- Distribution

- Customers

A supply chain, on the other hand, is the coordination, management and strategy that drives the flow of data, information and logistics to deliver the best product and service to all stakeholders in the process of converting raw goods to the end salable product.

Components of Logistics Include:

- Inbound Freight

- Outbound Freight

- Warehousing

- Materials Management

- Order Fulfillment

- Inventory Planning

- Demand Planning

Logistics is managed by companies through a transportation management system (TMS) that allows users to optimize and manage its logistics flows in a control tower fashion giving all stakeholders full visibility to future, current and past freight movements of goods through its supply chain.

The TMS platform also allows users to report, model, analyze and optimize a shipper’s freight movements for continuous performance improvement.

As transactions increase, so does the complexity and the sophistication of the logistics talent, technology and processes. Companies can opt to either manage their logistics functions internally or outsource the work to a third party logistics companies (3PLs).

Often times a company’s logistics strategy begins with their outbound freight, then it will bring its inbound vendor freight into its logistics strategy.

Managing inbound freight allows companies to better monitor and control its inventory levels and vendors, gain control of its inbound dock management, give its material management resource group full visibility for production builds and customer order processing.

The combination of managing both inbound and outbound brings efficiencies, scale and full visibility of all materials flowing through a company’s supply chain to allow it to more effectively manage its resources, provide a higher level of service and improve its order-to-cash cycle.

All said, the elevation of logistics from a cost center to a strategic pillar requires all companies, whether small or a enterprise, to excel in logistics for success.

Small to medium sized companies tend to be less sophisticated in their approach to logistics because they either do not have the budget to support or they are in rapid growth mode making it difficult to keep up with the needs. Either way, if a company does not invest in its logistics requirements, it could costs the company in overpaying for freight, struggling to maintain a consistent level of high service, market share and a sub-optimized order-to-cash cycle.

A cost effective way to dramatically improve logistics competence is to employ a third-party logistics company. An endorsement to the outsourcing model is that 90% of Fortune 500 companies engage in third-party logistics providers (3PLs) to help them in their drive to excellence.

There are several options to engage a third-party logistics company (3PL) ranging from partial to full outsourcing of warehousing, freight, logistics or full supply chain efforts.

For the purposes of this guide, we will focus on outsourcing freight & logistics managed TMS service solutions.

Before jumping into the managed transportation services option, let’s walk through a quick review of what falls under the umbrella of managed TMS or as some call it managed transportation services because it is much different than incorporating an LSP into a company’s freight strategy, as was outlined earlier.

LSPs offer both the service of being a freight service provider and a full managed logistics service solution and often a company will start using an LSP to operate within its current mix of freight carriers and in time move to the full outsourced model.

Managed TMS and the LSP freight model is different in five key areas:

Execution

- LSP: Operates as a freight provider, within a shipper’s overall freight strategy

- Managed TMS: The shipper sends all its orders to the LSP to optimize, route, tender and manage through to delivery

Ownership of Carrier Relationships and Contracts

- LSP: LSP owns the carrier relationships they use on the shipper’s freight and makes money on the buy-sell spread

- Managed TMS: The shipper owns the carrier agreements and the LSP makes its money on a monthly service fee based on transactions and services

Technology

- LSP: The LSP uses its technology to manage and optimize its service and cost.

- Managed TMS: The LSP provides the shipper with the technology it utilizes to manage their freight transaction. The LSP sets up multiple communication and reporting portals for the shipper and its customers to have full visibility into the flow of product

Market Knowledge

- LSP: While the LSP shares some of the knowledge, it typically holds it within as there really is not a mechanism to disperse to a shipper to add value in the relationship

- Managed TMS: The LSP brings all its talent and resources to be a strategic partner in the shipper’s business

Relationship

- LSP: Transactional relationship, with the LSP making its money on the buy-sell spread.

- Managed TMS: Fully transparent strategic relationship where the LSP passes through the logistics costs, then adds a monthly fee based on volumes and service

As a reminder, the below chart outlines all the functions performed by a 3PL in their full managed logistics program. As you read through the chart, know services can be added and subtracted to fit a shipper’s exact requirements.

Shippers, not only have options to choose from to create a customized outsourced service solution, they also have a multitude of options of outsourced freight and logistics 3PLs.

The Top 10 Largest Managed Transportation Companies we tend to see most often include:

- Transplace

- TMC - A CH Robinson Company

- Ryder Logistics

- Penske Logistics

- BluJay Solutions

- XPO Logistics

- Schneider Logistics

- GlobalTranz

- GEODIS

- Ruan

Each of the above companies have their strengths in the industry, which is why they and so many others have service offerings in the managed transportation space.

Transplace and TMC are the best known 800-pound gorillas in the managed TMS space and are found to be vying for any opportunity that is at least $25 million or more in freight spend. Both operate an internally developed TMS that comes with all the bells & whistles.

BluJay Solutions are often found in the same RFP circles as TransPlace and TMC because they are vying for the same type of customer. BluJay also has an internally developed TMS.

XPO, Ryder, Penske and Ruan are also big operators in the managed logistics space, but would say they tend to focus only on the largest of opportunities and therefore not a great fit for small to medium sized shippers. The solutions all three bring to the table often include their own assets for dedicated fleets used on the shippers largest two-way lanes.

While Globiz and GEODIS have come into the space similarly, Globiz, unlike GEODIS, stays strictly focused on managed transportation solutions. There is some question on their strength and how well it is all tied together because of the rapid growth it has come into via acquisition, but also because it is across a freight agent model where the agent offices are independently owned and operated.

The top ten largest are often not the best fit for the small to mid-tier market, although as the TMS technology gets cheaper and the above are looking for ways to increase their size are starting to move down the chain to the mid-tier market.

As we have repeatedly said in this guide, it is important there is a fit between the 3PL and the shipper. With that in mind, there are five other LSPs that need a call out. These five use the MercuryGate cloud TMS platform, which is one of the top TMS packages, as outlined by Gartner in their Magic Quadrant study every year.

Other 3PLs in the managed transportation services solutions include:

- InTek Freight & Logistics

- Transportation Insight

- Redwood

- Rockfarm

- Trinity Logistics

Transportation Insight is a formidable competitor that is lessor known, but often in the mix for medium to large shippers looking for a full outsourced freight logistics solution. They along with the next four operate their managed services through the MercuryGate TMS software platform.

Redwood, Rockfarm and Trinity Logistics can be found on many managed logistics services in the mid-sized market RFPs. Redwood and Rockfarm bring with them a strong relationship with MercuryGate allows them to offer great value for the mid-sized market

InTek Freight & Logistics is also a strong presence in the small to mid-tier shippers. As mentioned earlier, InTek also utilizes the MercuryGate cloud-based TMS software platform to deliver its services and like, Redwood and Rockfarm, has a unique relationship to leverage the best solution for the small to mid-tier market.

The reason why so many of the top outsourced service solutions providers utilize MercuryGate is because of its flexibility, technology, breadth of functionality and value. Knowing that 450,000 users log into MercuryGate everyday is one metric that affirms the strength of the MercuryGate platform, but so does its consistent top 5 ranking within the Gartner Magic Quadrant review every year.

To add to its strength, the MercuryGate transportation management software platform has itself tied into the major market databases to allow it users to easily access capacity and provide reporting against billions of dollars of freight spend to provide the best benchmarking analytics in the industry.

The future of managed transportation services continues to see blurring lines between technology, consulting services and straight up freight brokerage companies.

Managed TM services is a logistics service solution where providers utilize their technology, people and processes to solve the cost, service and capacity equation for shippers. Through outsourced logistics managed services shippers feed all their orders to a logistics service provider to then optimize, execute the load plan, tender shipments and manage them through delivery, afterwhich, the logistics provider will audit the freight invoices and supply the shipper with a weekly summary invoice to pay for the services.

Encompassed in the program is reporting, analytics, RFP execution and network optimization to help the shipper build a competitive advantage through excelling in logistics and supply chain management.

Outsourced solutions have long been a staple in warehousing and distribution, but has excelled into the area of other logistics and supply chain efforts. The evolution of managed TMS services came from the freight brokerage relationships shippers had developed, as a way to offload all their freight work into the hands of the experts that were moving a good majority of their freight already.

As technology improved, the more sophisticated and well capitalized LSPs stepped up the service offering to include a higher level of service to optimize and leverage a shipper’s freight moves and spend. In some instances, the freight broker, which we will now call a logistics service provider because its more advanced approach to the business either developed an internal transportation management system (TMS), while others chose to go with an off the shelf TMS.

The move towards building a TMS that better fit the needs optimization and leverage was the first step in blurring the lines between logistics service provider and TMS technology.

Basic tracking and spend reports were already a part of managed the initial managed service solution. The next step up in the blurring of the lines came as the reporting, analysis, network optimization was further enhanced and then combined with the multitudes of databases that have details of a large portion of all the freight market spend. This move blurred the lines between an outsourced managed TM program and consulting services. Now instead of a shipper asking a consulting company to evaluate their competitiveness in price and service against the market, they can get this through their managed logistics service provider on a monthly base. This blurring also brought down the cost of these consulting services from $50K on up to “part of the program”.

The blurring continues in the consulting service area, with managed logistics solutions offering RFP execution, as part of its service, whether it is for their managed TM customer base or others. The reason this was able to happen is the magnitude of data being collected externally makes it quick and easy for a logistics service provider to pull the data in for any shipper. Again, the costs of the RFP execution service has decreased dramatically because of the ease at which TMS systems can manage reams of data, while tying in external databases. This used to be another $50K, plus billing from consulting companies that is now part of a managed TMS program or a smaller charge for those shippers not within the LSP’s customer base.

Another segment of the freight market is the freight audit and pay companies. In many cases, these companies are finding they are being challenged and losing out to logistics service providers because this group has become highly proficient at this process because of the need to have it through their managed solutions. Initially freight audit and pay companies were able to ward off some of the LSPs because they had a bigger spend and could offer shippers market analysis based on their spend, but now that LSP’s are tapping into the larger freight market spend databases they are able to bring even more relevant data and value in their market analysis.

The blurring of the lines will continue into the future with the incorporation and integration of onboard electronic logging devices (ELDs), integration of public and private block chain technology, artificial intelligence, machine learning, etc.

Taking it up several steps further, the best-of-the-best logistics service providers will tie in both inbound and outbound freight movement, tie in with their customers’ ERPs, financial systems, etc., then moving into full supply chain management versus just managing their logistics function.

Transportation management systems are often called control towers, with a picture of an air traffic tower associated with the term and the TMS functionality. This is not far from the truth on where all this technology is headed within the logistics management industry is still up for debate, but can only say watch to see the control towers begin to talk with each other to blur the software capabilities with the physical moves over the road.

This blurring of the software and physical space will make autonomous driving, platooning of trucks, drones and other technologies a reality in optimizing the future of logistics and supply chains.

Like most things in business, there is not a one-size fits all solution and outsourced managed logistics and supply chain service solutions fall under this same umbrella.

With that in mind, shippers need to narrow their decision on the top three logistics service providers to include in their search, then have an RFP / functionality checklist that is weighted by importance to come to the ultimate decision.

To start out your buying journey, the following factors can boil down the selection field fairly quickly:

Size of your company’s freight spend

- While every managed TMS provider would like to say they can handle the largest shippers, it is not feasible because of the resource requirements needed for a successful launch would be too immense

Is the company culture a match?

.jpg?width=500&name=shopping-list-g935c8d63c_1920%20(1).jpg)

- Can you find the leadership speaking and engaging with the market?

- Professional associations and accreditations

Is a personal connection with the outsourced logistics company important?

- Does your company want to be a big fish in a small pond or just being with the biggest is where you feel most comfortable?

- Will the connection remain with the top of the organization or will they disappear after the sales process is complete?

Implementation cost and team match with your expectations

Technology platform and services to support business today and into the future

- Functionality

- Analytic capabilities

Our experience has found that many companies can have buyers remorse with their selection, but find it very difficult to justify a change and the cost and risk associated with it. For that reason alone, a company needs to evaluate the fit of the organization before even putting an RFP in the market.

If we were a buyer, we would tend to favor the companies that operate MercuryGate. The reason being is if there is not a fit or your company decides to change its strategic direction, then it can either find another operator that utilizes MercuryGate or you can bring the software in-house.

The internally developed software packages would be of concern because it would be very difficult to break away and how can they possibly keep the focus and resources on TMS functionality improvements and enhancements over the years against a company that is 100% focused on TMS technology and advancements to meet market demands and requirements head on..jpg?width=300&name=penny-g8cd935a35_1920%20(1).jpg) Another heads up is to be mindful of the shiny penny. In other words, be mindful of the flashy sales pitch and process. Often companies lose sight of the goals and get wound up with the flash. At the same time, remember that the sales process is often like dating, so don’t make excuses for them because of the flash and belief. Peel back the onion and make sure the outsourced service solution is a good cultural and functional fit.

Another heads up is to be mindful of the shiny penny. In other words, be mindful of the flashy sales pitch and process. Often companies lose sight of the goals and get wound up with the flash. At the same time, remember that the sales process is often like dating, so don’t make excuses for them because of the flash and belief. Peel back the onion and make sure the outsourced service solution is a good cultural and functional fit.

As in any selection process there are red flags, so do the homework and choose what is best for you, your team and your company in its quest to build a logistics and supply chain solution that will build a competitive advantage.

.jpg?width=500&name=Transit%20(2).jpg)

.jpg?width=250&name=Managed%20Transportation%20Basics%20(2).jpg)

.jpg?width=250&name=Why%20Managed%20Transportation_%20(1).jpg)