Chapters

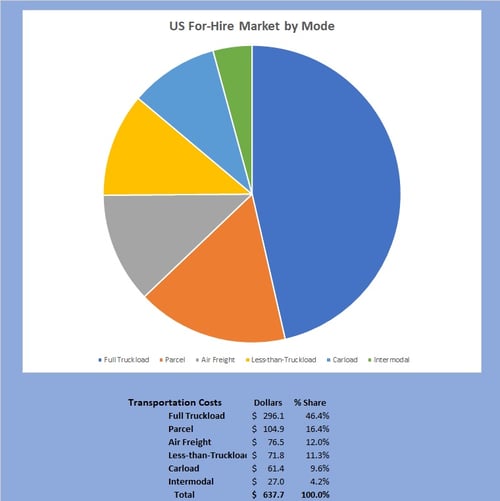

It can be overwhelming for shippers to find the right freight solution because there are so many options. In fact, according to the

With so many options, you can see why the decision process of identifying the “right fit” for your company can be so difficult.

With that said, the first priority for logistics professionals is to educate themselves on the various options in order to accurately evaluate which will be the most efficient for their shipping requirements.

To help in the education process, let’s take a look at the AT Kearney Annual State of Logistics Report which outlines the total revenue by freight mode. From there, we will take a deeper dive into the freight modes of truckload and LTL because of their prominence in every shipper’s logistics and supply chain.

Ebook: Comprehensive Guide on Managed Transportation

Download A Free Copy of Our eBook "Comprehensive Guide on Managed Transportation" to discover managed TMS will add capacity, reduce costs and improve logistics performance.

A study put out by the Aberdeen Group found 83% of companies interviewed have become aware of the cost and service impact transportation has on the overall supply chain performance of their company and see transportation as more than just an isolated budget line item to be monitored. The strategy many shippers have taken to change results for the better is bring a managed transportation service strategy through a well-respected logistics service provider.

Full Truckload

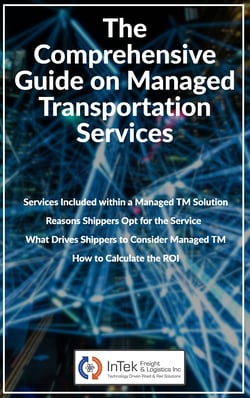

As the graph on the overall for-hire indicated, full truckload is the largest for-hire mode by market share at 46.4%. Whether it be dry van or refrigerated, shippers will experience quicker transits of their freight from origin to destination under this transportation mode versus the other 53' capacity option, intermodal.

Freight is typically configured and stretch-wrapped on pallets, then loaded into the trailer for transport. Shippers can also floor load or use slip sheets to load out the cargo trailer. Floor loading and slip sheeting a trailer increases the total usable cubic foot capacity for a trailer because it allows more product to be loaded because of the reduction in pallets space and weight of those pallets. Conversely, slip sheeting and floor loading increases the time for loading and unloading the product.

When selecting a freight providers, shippers can access a diverse set of options for truckload shipping (dry, temperature-controlled or Haz-Mat capacity) through a variety of the top freight brokers and logistics providers, although technology has really allowed freight brokers of all sizes to access the same capacity and price so it gets down to what is the best fit for the company.

Shippers can also access the truckload directly, but there is a limit to the total number of motor carriers they can manage independently.

Freight brokers or logistics service providers (LSP) are more efficient at tapping into the total market through their technology and staff that can be leveraged cost-effectively across a larger base of customers and revenues they have through their non-asset business model.

Not only is there a speed factor of finding the capacity through a non-asset provider, but also in their ability to quickly vet the carrier for safety and legal operating authority, along with putting the carrier under contract. All important factors to ensure the load is on the road legally.

LTL (Less-than-Truckload)

When shippers have freight shipments that are not large enough to fill the full capacity of a 53’ trailers they turn to LTL or less-than-truckload. Under this freight mode of shipping, the motor carrier aims to consolidate several LTL shipments from multiple shippers into one 53’ trailer by sweeping local and regional distribution centers that are then brought back to its transload cross-dock to load out the line hauls for the destination cities. Once at the destination cities, the loads are then transloaded at another cross-dock location to then be sent out on local deliveries. .jpg?width=400&name=Warehouse%20Forklift-01%20(1).jpg) There is more to the LTL model, which is what the industry calls a hub-and-spoke network operation, but this summary should be enough to get you started.

There is more to the LTL model, which is what the industry calls a hub-and-spoke network operation, but this summary should be enough to get you started.

Larger shippers can do their own consolidations by using a transportation management software (TMS) platform that optimizes its freight routes and rates to develop the most efficient and cost-effective load plan for the day’s shipments.

Freight consolidation is a logistics freight strategy where a shipper combines multiple LTL shipments within a particular geographic region into a truckload or intermodal that is then line hauled to a destination point where the shipments are broken down and shipped LTL to their final destination. Utilizing an LTL freight consolidation program brings with it many benefits that will be touched upon later in this guide.

Another freight service mode option is expedited. There are some industries that live on expedited freight, such as medical and JIT operations. This freight mode is the more expensive option for shippers, so our recommendation is to do all that is possible to limit expedited use which can include planning ahead, more communication and get teams involved to help them understand the cost implications this mode has on its budgets.

With the introduction of the two primary modes of freight transportation used within the US behind us, let us further unpack the topics of cost, comparison and other topics associated with how shippers utilize the various OTR (over-the-road) options to optimize their logistics and supply chains.

Truckload v. Less-than-Truckload (LTL)

As touched upon before, no freight mode is arbitrarily better than the other. Diversification is the only free lunch in logistics, so it is important to consider every freight mode and mix of modes to develop the best logistics strategy that meets a shipper’s requirements.

Assembling the best load plan for the day is essential in developing the most efficient and cost-effective method for a shipper to move its freight. The optimization process is best accomplished through a transportation management system (TMS) where a shipper’s freight is optimized on both rate contracts and mode that will meet the required pick-up and delivery schedules.

Modal conversion is where the biggest savings is derived in freight savings optimization. The purpose of making the transition between freight methods changed the way shippers move freight efficiently. One of InTek’s biggest strengths is helping shippers in modal conversion from truckload to intermodal shipments. By leveraging the versatility of truckload, alongside the efficiency of rail transportation, modal conversion from truckload and intermodal is simply put, access to long-term savings, amongst several other benefits.

What we would call the “pyramid of modal conversion” is listed below where the mode on the top is always being evaluated by TMS systems to consolidate into a mode below:

- Small Parcel

- LTL (less-than-truckload)

- Truckload

- Intermodal

In both truckload and LTL, it is impossible to deny the impact that “big data analysis” has had in transforming the freight cost savings.

The area where the greatest big data cost reductions come through is the conversion between the freight modes of LTL to truckload and from truckload to intermodal.

Modal conversion from truckload to intermodal has tremendous savings opportunities for shippers that can work with an additional transit associated with intermodal.

LTL cost savings through big data optimization can be attributed to the data analysis process capabilities of Transportation Management Systems (TMS). Big data also provides companies with the ability to analyze their full logistics and supply chain network for freight savings and KPI improvements.

Big data combined with the capabilities of a TMS brings several benefits to a shipper’s LTL and truckload freight and logistics network.

Increasing Efficiency in the “Final Mile Delivery”

The final mile delivery of any mode is the most inefficient and therefore costly. The connectivity in today’s TMS systems improve the capabilities of shippers and logistics service providers ability to drive out those inefficiencies. Simply put, knowledge is power, and the knowledge collected through big data is a powerful tool in the shipping analysis process, from origin to final destination.

Reliability Through Transparency

The improvements in a logistics and supply chain brought together in the mountains of data the modern TMS can quickly summarize make the most complex simple. The operators behind the screens can then see the transparency in the data to make better decisions to ensure the best cost and service is part of the equation every moment of the day.

By automating away what is operating well in the logistics network, the TMS gives a “bird’s eye view” of the exceptions that need attention to meet the RAD date, required arrival date. The elimination of the noise puts a laser focus on the issues that drive up costs while driving down performance and through the transparency comes the reliability.

Route Optimization

Transportation Management Systems (TMS) play a large role in the success of route optimization for all freight modes, but in particular, in the performance of LTL and truckload shipments as these freight modes are typically the largest share of moves within a company’s supply chain..jpg?width=400&name=stelvio-yoke-gc2bbabe5f_1920%20(1).jpg)

By utilizing a TMS and the data it collects, carriers can allocate resources in a more efficient manner. Once the freight is in motion the TMS will continue to provide the feedback to keep the freight on its course for on-time delivery. Putting too many resources, such as moving several LTL on the same O/D pairing on the same day versus consolidating them all into one truckload is increasing the cost of the freight lane and not capitalizing on efficiencies available within the day’s load plan.

Legal Weight Permitted to Load Cargo

Loading a truck more than it is legally allowed to be carried on the interstate is … well illegal. Public safety is number one and the Department of Transportation (DOT) takes its responsibility to ensure the roads are safe very seriously. So, if the load leaves your facility illegal, there is the potential of financial costs being levied for DOT fines; rework charges to make the load legal; delays in shipping on-time; and the possibility for huge lawsuits if the shipment that was loaded heavy were to be involved in a fatal accident.

The rule of thumb for each 53’ freight mode is what we have outlined below, but know there are exceptions to the rule.

- Dry Van Trailer: 44,000 to 45,000 pounds

- Intermodal: 42,500 pounds

- Refrigerated Reefer Trailer: 42,500 to 44000 pounds

- Flatbed Trailer: 48,000 pounds of cargo

For more on the topic of weight read: "What is the Legal Weight Shippers Permitted to Load Cargo?"

Logistics professionals are constantly trying to solve the price, capacity and service equation for their stakeholders. With that said, no guide would be complete without covering the topic of pricing.

Cost Components & Requirements for Pricing

There are essentially three cost components of truckload and LTL shipments:

- Base Rate (Line Haul)

- Fuel Surcharge

- Accessorial Fees

- Origin/Destination Zip Codes

- Weight, Pieces and Dimension of the Shipment

- Commodity

- Lead-Time

- Fuel Costs

- Transit Requirements

- Special Pick-up & Delivery Requirements that Drive Accessorial Charges

- NMFC Code (for LTL only)

- Type of Rate: Spot, Contract or Special Project Rates

Pricing Options

While there are specific details required to price freight, there are also various pricing schema to best match the freight capacity requirement at the best price.

Types of Freight Pricing

Contract

Contract pricing provides a guaranteed rate when the motor carrier has the capacity to move the load, as required by the shipper. The rates are typically in place for 12 months. The vast majority of shippers tend to do an annual RFP in the 4th quarter to match up with the financial budgeting process.

While we understand the financial teams desire to budget in the 4th quarter, it is typically not the best time of the year to go out for bid.

Our recommendation would be to bid freight somewhere between February 1st and March 30th, unless other market conditions would say otherwise.

The reason for the recommendation is logistics providers tend to price what they see in front of them versus what is actually happening in the market and with the 4th quarter being a high watermark in freight volume the provider is pricing during a more constrained market.

Spot

Unlike contract pricing, spot pricing is the price a freight rate providers offers for shippers at a specific point in time to move freight. Rate is obtained based on the market conditions in which the freight will be moved and the rate is requested, so the supply and demand of the day drives the spot price for immediate settlement.

The dynamic nature of the spot rate can be tracked by a TMS where it compiles all of the freight load boards on a macro basis to find the best rate and freight capacity. Additionally, motor freight carriers, freight brokers and LSPs typically keep themselves close to the market and educate themselves daily on where the issues reside.

Special Project

Project pricing is utilized for, as the name indicates, special projects of peak demand requirements. Special projects entail shipments with volume outside of what would be considered “expected” quantities.

Project pricing paves the way for firms to take advantage of favorable freight rates over a shorter period of time with guaranteed volumes for a freight broker or motor carrier to dedicate capacity to the shipper.

Volume

Volume shipping pricing is associated with LTL shipments that fall outside the typical less-than-truckload parameters, but not large enough to fall under full truckload parameters.

Volume LTL pricing warrants certain conditions met, including a shipment that is 1) minimum of 5,000 pounds, 2) greater than or equal to 6 pallets, and 3) takes up to 12 to 32 feet of trailer space.

With freight cost being one of the three pillars of a logistics professional, a great read to further dive into the costs associated with moving freight is How to Negotiate & Execute Best Freight Rates: Comprehensive Guide. This article provides the key components and process steps required to obtain the most freight capacity at the least cost.

Definition of Motor Carrier

A motor carrier is an asset-based freight provider entity that arranges the transportation of property for compensation. A motor carrier owns the assets and is primarily on the insurance for the freight they move.

According to the US Department of Transportation, there are over 700,000 motor carrier companies, with 91% operating 6 or fewer trucks and 97.3% operating fewer than 20 trucks.

Definition of Logistics Service Provider

Logistics Service Providers, or 3PL (third-party logistics) providers, are non-asset logistics and supply chain entities shippers leverage to manage a company's warehousing, distribution, and transportation of freight.

While comparable to freight brokers, because they run under the same type of FMCSA operating authority, LSPs typically operate a higher-end technology platform, have a larger knowledge base and offer additional services than that of a freight broker.

LSPs have a “big picture” logistics and supply chain strategy with their top tier transportation management software (TMS) and BI (business intelligence) to maximize its people, technology, processes and knowledge of the industry for more complex shipping solutions.

Definition of Freight Brokers

A freight broker is a non-asset freight provider entity that arranges transportation of property on a shipper’s behalf for compensation. A broker does not have the assets to transport the property themselves and does not assume responsibility for the property, therefore, are secondary on insurance through a contingent cargo insurance policy.

There are over 17,000 freight brokers licensed in the United States. It is important to remember both freight brokers and logistics service providers (LSPs) operate under a brokerage authority.

To determine whether your freight provider is a broker or a motor carrier and operating legally all one needs to do is go to the Federal Motor Carrier Safety Administration (FMCSA) site and input the providers USDOT and MC numbers.

Comparison Between Motor Carriers, Freight Brokers and LSPs

There are a number of differences between a motor carrier, freight broker and logistics service provider that are worth noting. The intention of the comparison is not to say one entity is better than the other, but to note the differences so a logistics professional can determine the best provider for the issue to maximize value and service.

Method of Moving Freight

Motor carriers physically own the assets for the freight they move for their customers, which could be a shipper, freight broker or logistics service provider.

The market value and offering motor carriers bring is asset freight capacity for the entire shipping market.

On the other hand, freight brokers do not own the assets for the freight they move for their clients. With that said, their market value is service. Logistic service providers have the same value add, however, LSPs do bring with them a more in-depth vision of the logistics and supply chain industry and technology.

Legal Possession of the Freight

Motor carriers take legal possession of freight they move for companies.

Freight brokers and logistics service providers, on the other hand, do not take legal possession of the freight.

Cargo Liability Coverage

It is the motor carrier’s responsibility for loss and damage once they sign the bill of lading (BOL) at pick-up until the receiver signs it the delivery location. It is important for the receiver to not make the signing of the BOL a “rubber stamp” process because if they sign it free and clear of damage there will be no recourse after the fact.

Freight brokers, on the other hand, do not take responsibility for the cargo onboard the motor carrier they contract for the freight it moves and is therefore not the ultimate party responsible for loss or damage that may occur in transit. Because of this, freight brokers do not hold a cargo liability insurance policy, but a contingent cargo liability policy, which ultimately protects freight brokers and the shipper if the motor carrier’s insurance policy does not honor the damage or loss.

It should be taken into consideration that this coverage will pay in the event that primary coverage does not suffice. There is the topic of Carmack Amendment that buyers of freight services need to understand because of its importance to claims and the circumstances that carriers can defend not taking liability for the shipments.

Final Pay Settlement

Motor carrier final financial pay settlement is straightforward, in that, once the motor freight invoice has been audited and approved for accuracy, the shipper is responsible to pay.

A freight brokers invoice is the same as mentioned with a motor carrier, with an additional twist. With a freight broker, the ultimate financial responsibility is between the shipper and the carrier. Consequently, if the freight broker finds itself unable to pay the carrier, then the shipper is left with the responsibility to pay. This should be a big warning flag for shippers that do not fully vet their freight brokers for financial stability because they may get stuck holding the bag on several invoices where they find themselves ultimately paying for the load twice: once with the broker and another time to the motor carrier.

Key Performance Indicators (KPIs)

It is important to note that a carrier, LSP and freight broker can have different to value-add services and KPIs for companies.

While there are several measurements that shippers find important for freight shipments it is important to understand what makes each of the freight provider entities tick, so to ensure alignment of goals.

The difference between KPIs of a motor carrier and an LSP is a motor carrier has a premium on measuring its hard assets to stay in business, while an LSP is all about measuring service because that is what it needs to excel at to keep itself in business.

Here is a listing of motor carrier and LSP key performance indicators.

Motor Carrier KPIs.jpg?width=500&name=truck-g15f140930_1920%20(1).jpg)

- Top Line Revenue

- Loaded Miles

- Empty Miles

- Cost-per-Mile

- Revenue-per-Truck

- Hours

- Tonnage

- Deliveries

- Fuel Economy per Vehicle, including

Idle Time - Safety

- Available Hours of Service (HOS)

- HOS Violations

- Unassigned Mileage by Vehicle

- Driver Turnover

- Freight Claims

LSP Key Performance Indicators

- Top Line Revenue

- Margin Spread

- Revenue and Profit per Headcount

- Routing Guide Compliance of Motor

- Carriers Used in Programs

- Accessorials as Percent of Freight

- Tender Acceptance versus Tender

Declined - On-Time

- Capacity Issues

- Detention, Dwell, and Demurrage

- Damage Claims

- Maintenance

- Invoice Accuracy

For more in-depth comparisons, we recommend reading the following articles:

One question we are often asked is who are the top LTL and truckload providers in the market today. Below is what we tell potential buyers of our services:

Answering this question and similar questions about our competition, so freely, often confuses people, but as we see it, the more informed we can make buyers in the journey the happier they will be with their decision. Now, this may cause people not to buy from us, but it is better to go this direction then have a customer that has buyer's remorse or one that is not a good fit for them or for us.

With that said, below is a listing of the biggest LTL, truckload and freight brokers in the US market. The companies are listed in order of size.

If you are wanting more after reading through the below lists, we recommend the following articles:

- Best LTL Companies (And How to Choose)

- Best Truckload Companies (And How to Choose)

- Top 20 Freight Brokerage Companies (& How to Choose The Best)

- Top 5 Expedited Freight Companies (and Expedited Service How-to Guide)

- Best Managed Transportation Companies (And How to Choose)

- Pros and Cons of Shipping Truckload

Best of LTL Companies

- FedEx Freight

- YRC Worldwide

- XPO

- Old Dominion

- TForce Freight

- Estes Express Line

- ABF Freight

- R&L Carriers

- Saia Inc.

- Southeastern Freight Lines

- Averitt Express

Best of Truckload

- Knight-Swift

- Schneider

- Landstar

- JB Hunt

- Prime

- Werner Enterprises

- CRST

- Crete

- CR England

- Roadrunner Freight

- Covenant Logistics

- Western Express

- Heartland Express

- Ruan

- Cardinal

- Marten

- Universal

- P. A. M. Transport

Best of Brokerage Companies

- CH Robinson

- Total Quality Logistics

- XPO Logistics

- Echo Global Logistics

- Worldwide Express

- Coyote Logistics

- Landstar System

- Schneider Logistics

- MODE

- GlobalTranz Enterprises

- JB Hunt Integrated Capacity Solutions

- Hub Group

- BNSF Logistics

- KAG Logistics

- Yusen Logistics

- England Logistics

- UberFreight

- ArcBest Company

- Allen Lund Company

- Redwood Logistics

Keep in mind when reading the biggest and best listings that there is no "one size fits all” solution, which is why we will go through some topics to consider when choosing what is required from any LTL or truckload provider to be the best fit for your company.

There is no “magic formula” to the use of motor carriers and freight brokers. The best way to establish the optimal goal for your company is to first establish a motor carrier network, and through this process, continually work towards developing mutually beneficial relationships with carriers across lanes.

By the time your network is established, freight brokers can carry the balance of capacity needs. Brokers are easier to vet, as there are more than 700,000 motor carriers in the United States to choose from. However, it is recommended to not use more than two or three freight brokers at a time. This recommendation stems from the risk of brokers bidding against each other, consequently artificially inflating prices because they tap into the same resources.

Another route to establishing the perfect motor carriers and freight brokers is to step up your non-asset resource to a logistics service providers, where they do all the heavy lifting in establishing the carrier/brokerage relationship through managed transportation service solutions while adhering to your operational model. With all of the brokerage and logistic service providers options available, it is important to consider the following elements throughout the vetting process:

Properly Licensed to Operate Legally

To validate that a freight provider is operating legally, asset or non-asset, it is highly recommended to log onto the Federal Motor Carrier Safety Administration (FMCSA) site and input the providers USDOT and MC numbers.

Multiple Modes & Service Offered

Freight brokers often offer several services. In order to prevent change down the line, keep in mind the more a freight broker has to offer the better opportunity it will have to optimize freight capacity at the best price for a company over the long haul, which is the ultimate goal for every company.

Adequate Insurance Coverage

Not all parties require or carry the same insurance, so it is important to look into the coverage before moving any freight with the new freight provider.

Additionally, you check the deductible and request to be listed on the policy and receive a certificate of insurance (COI) to validate.

Additional Certifications

While it may seem superfluous to some, the membership and involvement of a freight provider says a lot about a company. It is an important aspect of the quality of the provider. Organizations like TIA (Transportation Intermediaries Association) and IANA (Intermodal Association of North America), as well as the EPA's SmartWay Transport Partnership are a few of the many industry associations that validate an organization to a high standard level before accepting them into the association.

Also, check for the level of involvement of the team with the associations, meaning is it just a box they wanted to check or are they actively involved and contributing to the betterment of the associations they are members of.

Carrier Compliance History

Not only is it important that the freight provider is operating legally, but it is also important to ensure that the non-asset operators have a well documented and followed procedure that the motor carrier they employ are run through before they move a stick of freight.

This information should include how the freight broker qualifies, onboards and reviews its motor carriers to ensure there are no gaps where the carriers put on your loads could fall out of legal compliance.

It is crucial to align your company with the most reputable, service-oriented and knowledgeable logistics team, so they are well equipped to help you reach your company’s goals.

Before moving any further, let's talk about cargo insurance because of its importance. Surprisingly it's not often thought of topic when shippers select their freight providers.

Evaluating insurance coverage is crucial for the freight service provider vetting process. All too often, firms determine the insurance they have on their shipment is when they are filing a claim, which is way too late

There are several types of insurance provided and we recommend reading as much on the topic as possible, so let’s start the discussion.

Shipper's Interest Cargo Insurance Policy

Cargo insurance is a shipper’s interest “all-risk” coverage policy.

This type of insurance focuses on the actual cargo, not the carrier’s liability.

Damage or loss of goods is covered during the shipment from the point the carrier signs for shipment (pick-up) to the point the receiver signs (delivery), but with the following exclusions:

- Damage Due to Improper Packaging or Loading

- Employee Negligence

- Infestation

- Abandonment

Motor freight carriers and freight forwarders are the parties to carry shipper interest policies.

As mentioned earlier, it is important for shippers and receivers not to “rubber stamp” the BOL signing process, as it marks the time when the carrier is on and off the hook for loss and damage.

Contingency Cargo Insurance

Contingency cargo insurance is also held by freight brokers and logistics companies.

The purpose of contingency cargo insurance is to cover gaps that may be present with the cargo insurance of the underlying carrier on the shipment.

The insurance is “contingent” because it comes into effect only when the motor carrier fails to cover the damage or loss to the shipment. Specific factors that fall in the motor carrier’s shipper's interest cargo liability coverage include policy cancellation, loss or damage exclusions, refusal to cover, etc.

Carmack Amendment

An important aspect of filing insurance claims is the Carmack Amendment. This amendment is part of every freight provider policy a shipper signs and is one that will not be negotiable, which makes understanding what it means a top priority.

From a carrier’s perspective, this amendment is pivotal in listing the duties, rights, and liabilities of carrier parties in the event of cargo damage or loss claim, which are far too common in the day-to-day operations in the freight industry.

Essentially, the Carmack Amendment places 100% liability onto the motor carriers, unless they provide proof of negligence on behalf of the shipper or one of the five exceptions can be proven.

Five Exceptions under Carmack Amendment

Act of God

The “Act of God” exclusion can defend the carrier when a carrier experiences a natural disaster or physical anomaly. It is important to note this defense is not applicable in situations where a naturally occurring event such as a severe thunderstorm could be foreseen and predicted.

The “Public Enemy” or the “Act of war”

As the name of the exclusion implies, this defense is applicable when military forces, that are enemies of the United States government, cause the damage or loss.

An example of this defense would be most damaging acts during times of war, but not in the even the act is considered “organized crime.” Due to the fact that war has not been physically imposed on United States homeland, terrorism would be more commonly involved with the defense, but has yet to be brought into court as a defense.

Act of Default of Shipper

There are instances where the shipper is held responsible for the mistakes or negligence on their part. The faults of shippers can be found in loading and securing a load, insufficient packaging or mislabeling contents of a shipment.

The BOL is the overriding document when the details of the shipment are brought into question.

Public Authority

Government actions can negatively impact shipments and cause cargo damage indirectly, such as road closure or trade embargoes. This defense also extends to actions affecting the product itself, like product recalls. Since the carrier is not in control of implemented government actions, it cannot undertake a liability brought on because of it.

The Inherent Vice or Nature of Goods Transported.jpg?width=400&name=Grocery%20Produce%20(1).jpg)

If the product being shipped has an inherent nature or vice, meaning a motor carrier cannot prevent loss or damage because of it, the carrier cannot be held liable for it.

Temp-controlled food is a good example. Perishable products are susceptible to become spoiled or destroyed if not shipped property, but if the motor carrier took the appropriate steps to prevent all the issues it could, yet the product still is damaged, then this defense is appropriate.

Other Topics to Consider with Regards to Cargo Insurance

There are many other topics to consider under cargo insurance, here are a couple more to think about:- LTL cargo insurance coverage is based on the NMFC LTL classification, so while it may be great to get an FAK assignment on the cost of the freight, it also means that the insurance coverage is reduced also.

- Keep in mind most LTL coverage is a price per pound, so this could have a major impact and worth negotiating more coverage or aligning with an outside insurance company to gain the additional cargo coverage required.

- Shipping in and out of Mexico is another cargo insurance topic to be aware of when shipping cross-border.

- Any and all shipments within Mexico have zero cargo insurance coverage. Additional insurance can be purchased, but shippers need to know that it is not standard on their Mexico shipments.

To sum up the topic of cargo insurance, a shipper needs to know how to protect its product in transit. An ounce of prevention is worth a pound of cure. Two additional articles worth reading are: How To Eliminate LTL Damage and OS&D Claims and Definition of OS&D (And How-To Successfully File a Freight Claim).

While expedited shipping is not the biggest segment of the LTL and TL marketplace, its importance often punches far above its weight because of its importance to service, so we wanted to break this topic out to help shippers that struggle in this area.

The long-and-short of it is no matter how well things are prepared, it has to be considered that not every aspect of the shipping process is planned out or accounts for a hiccup. Consequently, the pressure of timeliness requires a shipper to opt for expedited freight services to make up for the unforeseen issue or just because of the nature of the business.

Expedited freight companies fulfill this very specific niche to bring the best results to what often seems like a dire situation of fulfilling a shipment delivery requirement.

Unfortunately, the best national expedited freight companies are often not the best for every situation and a shipper needs to find a regionally-based solution for the best service and price for the same or next day service.

The good news is there are numerous local and regional expedited options, but they're often hard to find without engaging a freight broker or LSP because of the nature of the business.

With the bad news behind us, let’s jump to the good news … there are several types of expedited freight solutions for domestic, cross-border and international shipments.

Types of Expedited Shipping Services

Same Day - Air Charter Services

This option is the most expensive, as it is measured by cost per pound. The aircraft for this type of shipment is solely devoted to freight alone. Aircrafts for any size can be charted for this type of shipment as well, from a single prop plane to a Boeing 747.

Next Flight Out (NFO) - Air Freight Services

There are two types of air freight: commercial and cargo services.

Cargo services are defined by moving any number of pallets of freight via aircraft through cargo freight carriers.

Commercial services come via commercial aircraft putting freight “in the belly” of the plane.

The easier of the services for a shipper to use is through cargo services because they offer door-to-door service, while commercial options require a shipper to handle three legs of the shipment or go through a freight forwarder that is well versed in the area to get the one-stop door-to-door service.

Next-Day - Ground Expedited Services

If the origin and destination can be done within a day, next-day ground services are the best value option. Because proximity is important, these tend to be small regional operators using the following equipment:

Cargo Van

Weight Capacity: 2,000 pounds

Number of Standard Skids: 2

Sprinter Van

Weight Capacity: 3,250 pounds

Number of Standard Skids: 3

Straight Truck

Weight Capacity: 12,500 pounds

Number of Standard Skids: 10

Note on Straight Truck services: Expedited teams are notable in this category. This is where a team of two drivers is assembled to keep a truck moving constantly. This type is also common in truckload as well.

Tractor Trailer Teams

Weight Capacity: up to 45,000 pounds

Number of Standard Skids: 26

Hotshots

Hotshot expedited freight services typically refer to moving freight via a Class 3-5 truck used in combination with a variety of trailers to run freight for a single customer.

The phrase and method are thought to have originated in the energy fields in Texas when the equipment was moved quickly from one location to another to keep the oil field pumping crude.

It is important to note when choosing expedited freight services you need to come with the details so you can get the best value and service.

LTL Consolidation

Less-than-truckload is one of the most difficult freight moves to pat down to perfection. There are several obstacles in the way; NMFC class ratings, confusing tariff schedules, various service coverage maps, and claims.

We previously mentioned the concept of LTL consolidation. This is a phrase for a logistics strategy where a shipper combines multiple shipments within a certain region into a single shipment container. After shipment arrives to its final destination, the shipments are broken down into smaller shipments to be transported to their respective final destinations. The main takeaway from this approach is the freight cost savings by putting many into one.

Above is a visual representation of the difference between “Normal LTL” and the routes after “Pooling.”

It is estimated that shippers can save on their LTL transportation spend by 10% or more through a pool distribution or consolidation strategy. Along with cost savings, pooling can reduce delivery times and reduce damage.

Ultimately it solves the problem of multi-stop truckload freight, which is getting more difficult to source beyond two or more stops.

Successful consolidation is comprised of three elements: geographic density, volume, and technology.

The technology that is found in an advanced TMS software system can aid in optimization, bringing together information of shipping details, and visibility.

Transloading Services

Transloading is the process of transferring goods from one mode of transportation to another to finish the origin to the final destination process. This process is most useful when it is not physically or economically feasible to transport goods within the same method. Transloading is most often used during international shipments due to geographic restrictions, specifically through moving ocean containers to inland distribution centers..jpg?width=500&name=Transloading-01%20(1).jpg)

Transloading services can reduce total landed costs and when combined with value-added services such as palletizing and shrink wrapping, reduce the overall handling at the destination DC for delivery.

Other Freight Cost-Saving Ideas

It is hard to cover every cost savings opportunity available to shippers, so in the interest of keeping on target of key points within the truckload and LTL market, we invite you to read several articles.

By far the number one article to read is "How-to Negotiate & Execute Best Freight Rates: Comprehensive Guide." This article is the most comprehensive article on how shippers can manage, negotiate and benchmark their results as the large professional supply consulting firms do, without their fees.

The following two articles cover transportation management systems (TMS) technology and what it brings in service and cost savings to an organization. Both are must-reads.

- Transportation Management System: Functionality, Benefits & Implementation Success Guide

- Benefits of Managed Transportation Services: Comprehensive Guide

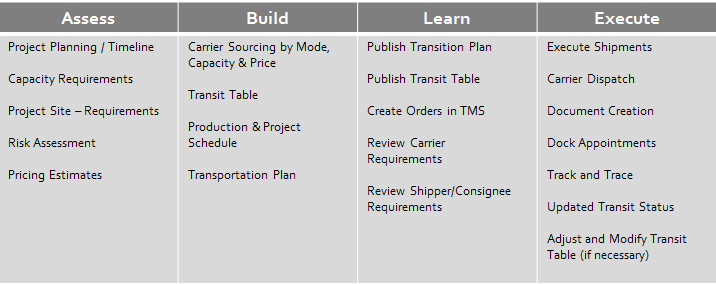

How to Manage Project & Surge Freight Situations for Best Results

Project-based and season freight surges are very similar in the capacity demand surge they put on an operation. These projects and surge freight opportunities can either be a huge win or a time of trouble. It all gets down to how they are organized, then managed for success.

Obtaining freight capacity and gathering the resources to manage freight moves that are exponentially above typical volumes is required to manage surges in volumes.

Quite often additionally reporting, tracking and management is required for this type of freight movements because it is often a make or break period for a company, which is why it often makes sense to gain outside help in a managed freight program.

Finding the best fit can be a daunting process, but with planning out the buying process and defining the end results create tremendous cost and service savings, while also building a company’s logistics and supply chain into a competitive advantage.